About the Pension

The American Federation of Musicians and Employers’ Pension Fund (AFM-EPF) is a trust fund established by the American Federation of Musicians (AFM) and various musical industry employers through collective bargaining. Generally, funding comes from contributing employers who are engaged in industries such as live theatre, motion picture, television, commercials, music videos, and casual engagements and who have Collective Bargaining Agreements with the AFM or an affiliated Local Union.

The Fund is governed by a Board of Trustees made up of an equal number of representatives of the AFM (labor) and the Employers (management). Employees and Employers participate in the AFM-EPF, depending on the terms of their Collective Bargaining Agreement. A Collective Bargaining Agreement is any collective bargaining, participation, or other written agreement acceptable to the Board of Trustees requiring an Employer to make contributions to the Fund on behalf of its employees.

Why Pensions Are Important

Musicians often work with multiple employers, so having access to a pension that covers a range of workplaces—through collective bargaining agreements, churches, music festivals, nursing homes, theaters, small orchestras, chamber groups, and even self-employment—provides essential retirement security for both musicians and their families.

Contracts

The AFM’s LS-1 form or the Local 427-721’s single engagement contract form enables musicians to build pension into their work with a minimum of fuss for their client or employer.

The LS-1 is a simple two-page engagement and pension contract. It doesn’t have a lot of legalese, and conveniently permits the employer or client to transfer to the lead musician or contractor the responsibility of reporting and sending the pension payments to the pension fund. The employer/client pays for it; they just don’t have to worry about the details. One contract form can be used for multiple dates as long as it’s for the same client/employer in the same venue for up to a one-month time span. The LS-1 eliminates the necessity of the employer/client writing two checks and it allows unincorporated solo performers and band leaders to receive pension credit.

Contributions for Teaching Music

In 1995, the Fund’s Board of Trustees addressed the question of pension contributions for private music lessons. Specifically, the Board discussed whether the Fund may accept pension contributions made on behalf of a musician by a person to whom a musician gives music lessons (or the person’s parents) based on amounts paid to the musician for the music lesson. The Board concluded that, in this circumstance, the musician is an independent contractor and not an employee of the person to whom the musician is giving lessons, and therefore the Fund is not permitted to accept pension contributions on earnings for those services.

The Fund may, however, accept pension contributions from an entity that, unlike individual persons to whom you may provide music lessons, is an employer—that is, an entity with the right to control and direct you as to both the result of your work and the manner in which your work is to be performed. For instance, a music school may make contributions on your behalf with respect to wages that you earn from the school for services such as music lessons. A personal service corporation may also make contributions to the Fund on behalf of its employee. Accordingly, if payment for music lessons is made to your personal service corporation, and the corporation in turn pays you wages for those lessons as its employee, the Fund may accept contributions from the corporation that relate to those wages.

The Fund cannot always determine from a participation agreement whether contributions are appropriately made on behalf of someone acting as an employee. You should be aware that, if the Fund does discover that contributions were incorrectly made for work you did not perform as an employee, you will not be eligible for a pension based on those amounts. Accordingly, if you have already had contributions paid into the Fund for music lessons that you did not provide as an employee, we suggest that you contact the individual who paid the pension contributions and ask that they send the Fund a written request for a refund of those contributions.

Contact

If your organization would like to file pensionable contracts for your musicians, please Contact Us.

Resources

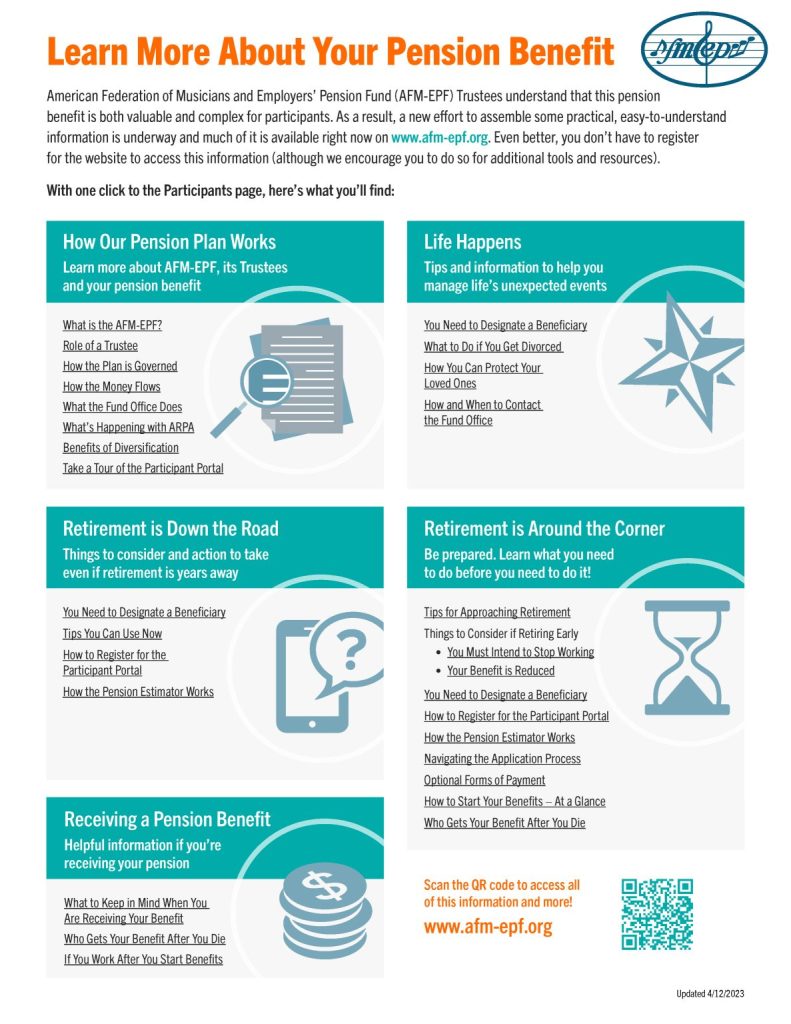

AFM-EPF: Learn About Your Pension Benefit